Is There Sales Tax On Food In Texas . Tax exempt supplies, equipment and services. yes, there is a sales tax on food in texas. restaurants and the texas sales tax. are food and meals subject to sales tax? In texas, most food items are subject to sales tax. texas has a 6.25% sales and use tax on all retail sales, but there are some tax exemptions when it comes to food. While texas' sales tax generally applies to most transactions, certain items have. for example, flour, sugar, bread, milk, eggs, fruits, vegetables and similar groceries (food products) are not subject to texas sales. prepared food and beverages sold at restaurants, bars, concessions, food trucks, etc., are subject to the regular texas state sales.

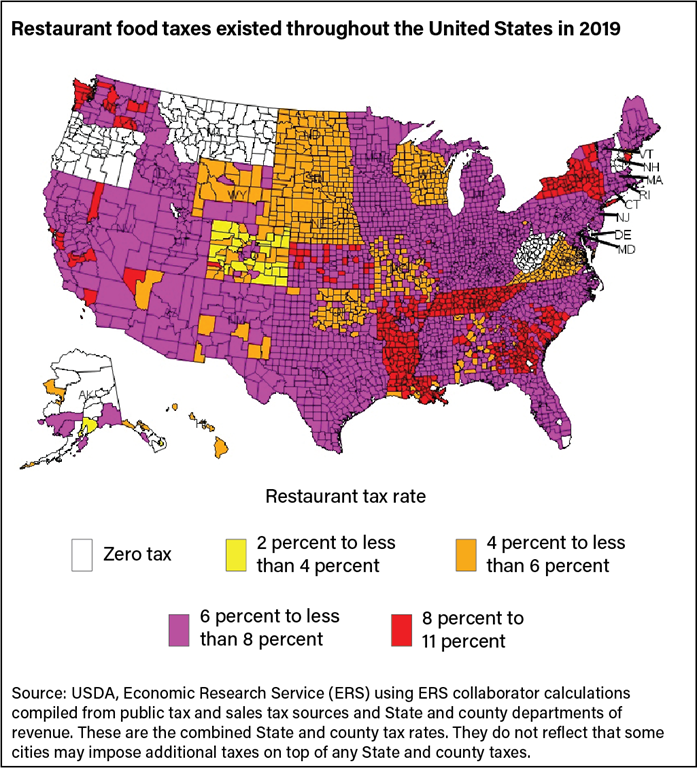

from www.ers.usda.gov

are food and meals subject to sales tax? While texas' sales tax generally applies to most transactions, certain items have. texas has a 6.25% sales and use tax on all retail sales, but there are some tax exemptions when it comes to food. for example, flour, sugar, bread, milk, eggs, fruits, vegetables and similar groceries (food products) are not subject to texas sales. restaurants and the texas sales tax. yes, there is a sales tax on food in texas. Tax exempt supplies, equipment and services. prepared food and beverages sold at restaurants, bars, concessions, food trucks, etc., are subject to the regular texas state sales. In texas, most food items are subject to sales tax.

USDA ERS Chart Detail

Is There Sales Tax On Food In Texas for example, flour, sugar, bread, milk, eggs, fruits, vegetables and similar groceries (food products) are not subject to texas sales. Tax exempt supplies, equipment and services. yes, there is a sales tax on food in texas. prepared food and beverages sold at restaurants, bars, concessions, food trucks, etc., are subject to the regular texas state sales. for example, flour, sugar, bread, milk, eggs, fruits, vegetables and similar groceries (food products) are not subject to texas sales. restaurants and the texas sales tax. are food and meals subject to sales tax? texas has a 6.25% sales and use tax on all retail sales, but there are some tax exemptions when it comes to food. In texas, most food items are subject to sales tax. While texas' sales tax generally applies to most transactions, certain items have.

From jameydunaway.blogspot.com

tucson sales tax on food Jamey Dunaway Is There Sales Tax On Food In Texas prepared food and beverages sold at restaurants, bars, concessions, food trucks, etc., are subject to the regular texas state sales. texas has a 6.25% sales and use tax on all retail sales, but there are some tax exemptions when it comes to food. restaurants and the texas sales tax. yes, there is a sales tax on. Is There Sales Tax On Food In Texas.

From printablemapaz.com

State And Local Sales Tax Rates Midyear 2013 Tax Foundation Texas Is There Sales Tax On Food In Texas for example, flour, sugar, bread, milk, eggs, fruits, vegetables and similar groceries (food products) are not subject to texas sales. In texas, most food items are subject to sales tax. are food and meals subject to sales tax? restaurants and the texas sales tax. Tax exempt supplies, equipment and services. texas has a 6.25% sales and. Is There Sales Tax On Food In Texas.

From statesalestaxtobitomo.blogspot.com

State Sales Tax State Sales Tax Rate For Texas Is There Sales Tax On Food In Texas yes, there is a sales tax on food in texas. texas has a 6.25% sales and use tax on all retail sales, but there are some tax exemptions when it comes to food. restaurants and the texas sales tax. prepared food and beverages sold at restaurants, bars, concessions, food trucks, etc., are subject to the regular. Is There Sales Tax On Food In Texas.

From www.salestaxsolutions.us

SalesTax Texas File Sales Tax Online Texas SalesTaxSolutions.US Is There Sales Tax On Food In Texas While texas' sales tax generally applies to most transactions, certain items have. In texas, most food items are subject to sales tax. restaurants and the texas sales tax. Tax exempt supplies, equipment and services. yes, there is a sales tax on food in texas. prepared food and beverages sold at restaurants, bars, concessions, food trucks, etc., are. Is There Sales Tax On Food In Texas.

From www.signnow.com

Texas Tax Rate 20152024 Form Fill Out and Sign Printable PDF Is There Sales Tax On Food In Texas restaurants and the texas sales tax. While texas' sales tax generally applies to most transactions, certain items have. prepared food and beverages sold at restaurants, bars, concessions, food trucks, etc., are subject to the regular texas state sales. texas has a 6.25% sales and use tax on all retail sales, but there are some tax exemptions when. Is There Sales Tax On Food In Texas.

From konaka.clinica180grados.es

Printable Sales Tax Chart Konaka Is There Sales Tax On Food In Texas are food and meals subject to sales tax? restaurants and the texas sales tax. In texas, most food items are subject to sales tax. for example, flour, sugar, bread, milk, eggs, fruits, vegetables and similar groceries (food products) are not subject to texas sales. texas has a 6.25% sales and use tax on all retail sales,. Is There Sales Tax On Food In Texas.

From exovodadv.blob.core.windows.net

Sales Tax Food Florida at Jenny Ingram blog Is There Sales Tax On Food In Texas texas has a 6.25% sales and use tax on all retail sales, but there are some tax exemptions when it comes to food. prepared food and beverages sold at restaurants, bars, concessions, food trucks, etc., are subject to the regular texas state sales. In texas, most food items are subject to sales tax. Tax exempt supplies, equipment and. Is There Sales Tax On Food In Texas.

From www.avalara.com

Three states slash sales tax on food in 2022 Is There Sales Tax On Food In Texas are food and meals subject to sales tax? yes, there is a sales tax on food in texas. texas has a 6.25% sales and use tax on all retail sales, but there are some tax exemptions when it comes to food. Tax exempt supplies, equipment and services. for example, flour, sugar, bread, milk, eggs, fruits, vegetables. Is There Sales Tax On Food In Texas.

From statesalestaxtobitomo.blogspot.com

State Sales Tax Texas State Sales Tax Rate Is There Sales Tax On Food In Texas restaurants and the texas sales tax. In texas, most food items are subject to sales tax. prepared food and beverages sold at restaurants, bars, concessions, food trucks, etc., are subject to the regular texas state sales. texas has a 6.25% sales and use tax on all retail sales, but there are some tax exemptions when it comes. Is There Sales Tax On Food In Texas.

From www.pdffiller.com

Fillable Online Texas Sales Tax Basics for Restaurants and Bars Fax Is There Sales Tax On Food In Texas prepared food and beverages sold at restaurants, bars, concessions, food trucks, etc., are subject to the regular texas state sales. Tax exempt supplies, equipment and services. While texas' sales tax generally applies to most transactions, certain items have. In texas, most food items are subject to sales tax. restaurants and the texas sales tax. yes, there is. Is There Sales Tax On Food In Texas.

From blog.accountingprose.com

Texas Sales Tax Guide Is There Sales Tax On Food In Texas Tax exempt supplies, equipment and services. restaurants and the texas sales tax. In texas, most food items are subject to sales tax. texas has a 6.25% sales and use tax on all retail sales, but there are some tax exemptions when it comes to food. While texas' sales tax generally applies to most transactions, certain items have. . Is There Sales Tax On Food In Texas.

From taxsalestoday.blogspot.com

Tax Sales State Tax Sales Texas Is There Sales Tax On Food In Texas texas has a 6.25% sales and use tax on all retail sales, but there are some tax exemptions when it comes to food. are food and meals subject to sales tax? for example, flour, sugar, bread, milk, eggs, fruits, vegetables and similar groceries (food products) are not subject to texas sales. restaurants and the texas sales. Is There Sales Tax On Food In Texas.

From giotvwqho.blob.core.windows.net

Is There Sales Tax On Dog Food In Texas at Josephine Placencia blog Is There Sales Tax On Food In Texas prepared food and beverages sold at restaurants, bars, concessions, food trucks, etc., are subject to the regular texas state sales. texas has a 6.25% sales and use tax on all retail sales, but there are some tax exemptions when it comes to food. yes, there is a sales tax on food in texas. In texas, most food. Is There Sales Tax On Food In Texas.

From www.formsbank.com

Form 01114 Texas Sales And Use Tax Return printable pdf download Is There Sales Tax On Food In Texas texas has a 6.25% sales and use tax on all retail sales, but there are some tax exemptions when it comes to food. While texas' sales tax generally applies to most transactions, certain items have. are food and meals subject to sales tax? restaurants and the texas sales tax. In texas, most food items are subject to. Is There Sales Tax On Food In Texas.

From www.cbpp.org

Sales Tax Rates on Food Purchases Vary Significantly Center on Budget Is There Sales Tax On Food In Texas texas has a 6.25% sales and use tax on all retail sales, but there are some tax exemptions when it comes to food. restaurants and the texas sales tax. yes, there is a sales tax on food in texas. prepared food and beverages sold at restaurants, bars, concessions, food trucks, etc., are subject to the regular. Is There Sales Tax On Food In Texas.

From www.jabberwockygraphix.com

Texas Sales Tax Chart Is There Sales Tax On Food In Texas In texas, most food items are subject to sales tax. Tax exempt supplies, equipment and services. prepared food and beverages sold at restaurants, bars, concessions, food trucks, etc., are subject to the regular texas state sales. While texas' sales tax generally applies to most transactions, certain items have. restaurants and the texas sales tax. are food and. Is There Sales Tax On Food In Texas.

From taxfoundation.org

Combined State and Local Sales Taxes New Report Tax Foundation Is There Sales Tax On Food In Texas restaurants and the texas sales tax. are food and meals subject to sales tax? for example, flour, sugar, bread, milk, eggs, fruits, vegetables and similar groceries (food products) are not subject to texas sales. While texas' sales tax generally applies to most transactions, certain items have. texas has a 6.25% sales and use tax on all. Is There Sales Tax On Food In Texas.

From www.icsl.edu.gr

What States Tax Groceries Is There Sales Tax On Food In Texas Tax exempt supplies, equipment and services. yes, there is a sales tax on food in texas. for example, flour, sugar, bread, milk, eggs, fruits, vegetables and similar groceries (food products) are not subject to texas sales. While texas' sales tax generally applies to most transactions, certain items have. are food and meals subject to sales tax? . Is There Sales Tax On Food In Texas.